- May 12, 2025

- Posted by: admin

- Category: Resources

Are you an MSME owner in Nigeria trying to scale your business but constantly facing funding or tax hurdles? This article is for you.

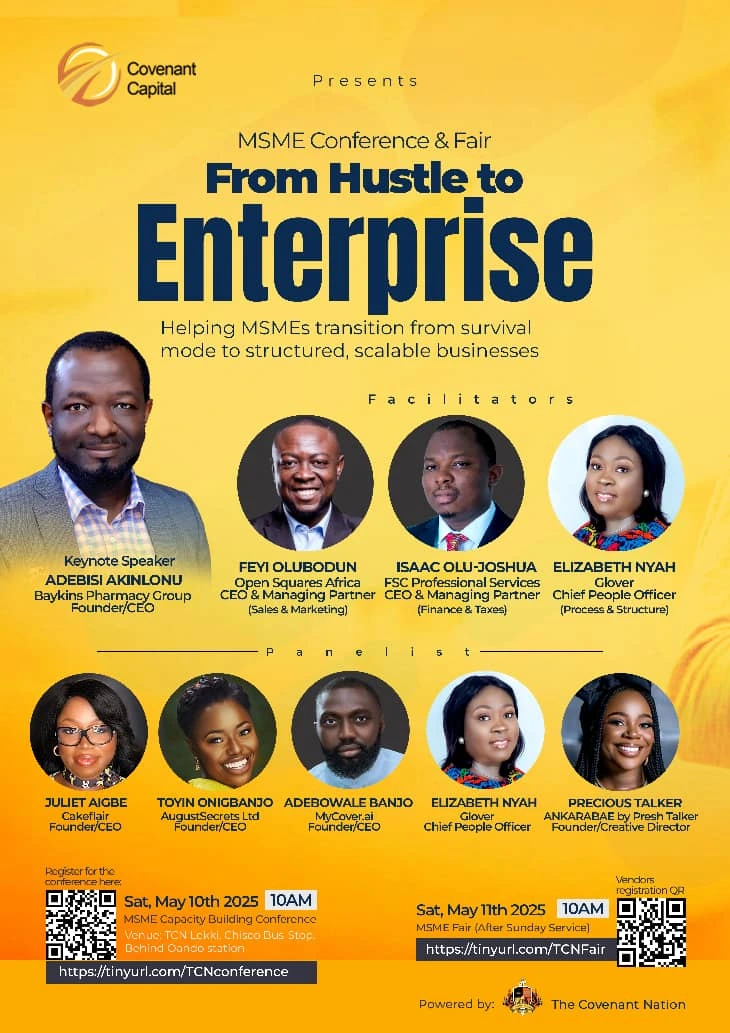

At the recent Covenant Capital MSME Conference 2025, our Principal Partner, Isaac Olu-Joshua, had the privilege to facilitate a masterclass on Finance and Tax Management for SMES in Nigeria.

Many MSMEs operate in survival mode, but with the right knowledge and systems, they can evolve into structured, scalable enterprises.

Why Financial Management Matters for MSMEs

Good financial management is the lifeline of any business. It’s not just about tracking expenses, it’s about making informed decisions that can determine your company’s future.

Here are five reasons financial management is crucial:

-

Financial Control & Decision-Making: Stay in charge of your business performance.

-

Compliance with Legal Requirements: Avoid penalties and shutdowns due to non-compliance.

-

Improved Access to Loans and Investor Confidence: Financial records are proof of credibility.

-

Strategic Business Growth: Know where to cut costs and where to scale.

-

Fraud Prevention & Risk Management: Spot discrepancies before they become disasters.

Real-Life Case Study: When Hustle Fails Without Structure

Let’s talk about Tolu, a business owner like many in Nigeria.

He recently landed a ₦5 million profit contract for supplying construction materials. To deliver, he needed ₦25 million. Though ₦10 million sat in his business account, he needed a ₦15 million loan.

Unfortunately, the bank denied him the loan. Why?

-

No audited accounts (for the past 3 years)

-

No management accounts

-

No Tax Clearance Certificate (TCC)

Result: The contract was cancelled. His hustle couldn’t deliver without structure. Don’t let this be your story.

Financial Statements Every SME Must Understand

Even if you’re not a finance person, you must understand these three reports:

-

Balance Sheet: What your business owns vs. owes

-

Income Statement: Your revenue, cost, and profit

-

Cash Flow Statement: Where your money is coming from and going to.

These help you track profitability, sustainability plan, and report credibly to stakeholders.

Bookkeeping Essentials for Small Businesses

You don’t need to hire a finance manager from day one, but you MUST maintain these records:

-

Cash Book: Track all your inflows and outflows.

-

Sales & Purchase Records: Know who buys from you and who you buy from.

-

Inventory Records: Especially critical for product-based businesses.

-

Payroll Ledger: For staff salaries, benefits, and PAYE deductions.

-

Fixed Asset Register: For things like laptops, machinery, and vehicles.

-

Tax Register: To document returns and receipts for all taxes paid.

Tips for Accurate Record-Keeping

Here’s how to stay organized and audit-ready:

-

Separate personal and business accounts

-

Digitally back up your records (Google Drive, Dropbox, etc.)

-

Reconcile bank statements monthly

-

Keep physical and digital receipts/invoices

-

Hire or consult a professional accountant regularly

Taxes Relevant to Nigerian SMEs

Understanding your tax obligations is crucial for survival and growth.

Key Taxes to Know:

-

Company Income Tax (CIT)

-

Value Added Tax (VAT)

-

Tertiary Education Tax (EDT)

-

Withholding Tax (WHT)

-

Personal Income Tax (PAYE)

Where to Register:

-

LIRS eTax: https://etax.lirs.net/register

-

FIRS TaxProMax: https://taxpromax.firs.gov.ng/

-

TCC Portal: https://tcc.firs.gov.ng/taxpayer/login

Tax Implications Based on Your Business Type

Sole Proprietorship / Partnership

-

Staff PAYE (deduct and remit monthly)

-

Self-assessment tax for the owner

-

Withholding Tax (WHT) where necessary

-

VAT (if turnover is above ₦25 million annually)

Limited Liability Company

-

CIT and Education Tax

-

PAYE for directors and staff

-

WHT and VAT

After Incorporation: Don’t Forget

-

Register for TIN (Tax Identification Number)

-

Enrol in VAT and TaxProMax (FIRS) + eTax (LIRS) platforms

-

File monthly, quarterly, and annual returns as due

Legitimate Tax Avoidance Tips for SMEs

Avoiding tax legally (not evading) is part of a smart business strategy. Here’s how:

-

Maintain separation between business and personal expenses

-

File all taxes promptly to avoid penalties

-

Keep good records to back up your deductions

-

Claim all allowable exemptions (e.g., pioneer status)

-

Get advice from a licensed tax consultant

Final Thoughts: Your Hustle Deserves Structure

Whether you’re running a baking business, a tech startup, or a fashion brand, structure your finances now. It will open doors to funding, build investor trust, and protect your business from avoidable risks.

Your hustle becomes an enterprise when your finances work for you, not against you.

📌 Need help setting up your finance structure, registering for taxes, or preparing your audit trail?

Reach out to us at FSC Professional Services, we guide SMEs on their journey to structure, compliance, and sustainable growth.

📧 Contact: info@fscprofessionals.com

📞 Phone: +2347038699425, +2347030026343

🌐 Website: www.fscprofessionals.com